§3(21) Co-Fiduciary vs. §3(38) Investment Manager

A fiduciary is someone who manages another party's assets and stands in a special relationship of trust, confidence, and/or legal responsibility. That person has a legal and ethical obligation to put the other party's interests first. For the retirement plan advisor, that means helping a client make decisions on behalf of their retirement plan’s participants and their beneficiaries best interests.

of trust, confidence, and/or legal responsibility. That person has a legal and ethical obligation to put the other party's interests first. For the retirement plan advisor, that means helping a client make decisions on behalf of their retirement plan’s participants and their beneficiaries best interests.

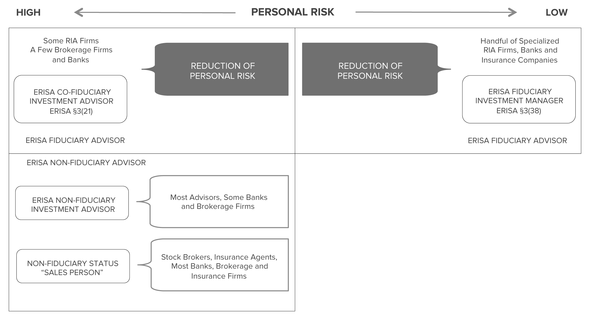

A retirement plan advisor can serve in either a §3(21) or §3(38) fiduciary capacity, and in some cases, both capacities. The needs and desires of the plan sponsor typically dictate the specific arrangement, which is predicated upon the subject of risk mitigation versus risk avoidance. Some plan sponsors want assistance with their fiduciary responsibilities but want to maintain discretion and control of their plan's investment menus. Others want to shift the fiduciary responsibilities to a third party due to their lack of expertise, and ultimately, fear of exposure to liability.

Differences: Any individual is a fiduciary under Section 3(21) if he or she exercises any authority or control over the management of the plan or the management or disposition of its assets; if he or she renders investment advice for a fee (or has any authority or responsibility to do so); or if he or she has any discretionary responsibility in the administration of the retirement plan.

Section 3(38) defines “investment manager” as a fiduciary due to their responsibility to manage the plan's assets. ERISA provides that a plan sponsor can delegate the responsibility (and thus, likely the liability) of selecting, monitoring and replacing investments to a §3(38) investment manager/fiduciary. A §3(38) fiduciary may only be a bank, an insurance company, or a registered investment advisor (RIA) subject to the Investment Advisers Act of 1940.

TYPE OF

INVESTMENT ADVISOR TO PLAN

QUESTION |

NON-FIDUCIARY |

CO-FIDUCIARY ERISA §3(21) |

INVESTMENT MANAGER ERISA §3(38) |

BENEFITS TO PLAN SPONSOR |

|

NO |

NO |

YES |

|

|

NO |

NO |

YES |

|

|

NO |

NO |

YES |

|

|

NO |

NO |

YES |

|

|

NO |

MAYBE/ DEPENDS |

YES |

|

|

NO |

MAYBE/ DEPENDS |

YES |

|

|

NO |

MAYBE/ DEPENDS |

YES |

|

|

NO |

MAYBE/ DEPENDS |

YES |

|

|

NO |

NO |

YES |

|

|

NO |

MAYBE/ DEPENDS |

YES |

|

|

NO |

NO |

YES |

|

|

NO |

MAYBE/ DEPENDS |

YES |

|

Similarities: Both §3(21) and §3(38) advisors accept fiduciary responsibility and adhere to ERISA §404(a)'s duty to serve solely in the interest of plan participants and both have to meet the “prudent man” standard of care. Plan sponsors retain the responsibility to select and monitor the advisor, regardless of their advisor's fiduciary status. Plan sponsors should consider the advisor's education, experience, skill and level of expertise, in addition to their desire to take on exposure to potential liability. Additionally, the advisor's broker/dealer permissions should be taken under consideration as well as the advisor's Errors & Omissions (E&O) liability coverage.

Remember, anyone can call themselves a fiduciary, but a fiduciary is determined by actions, not by title.