Sponsor Services

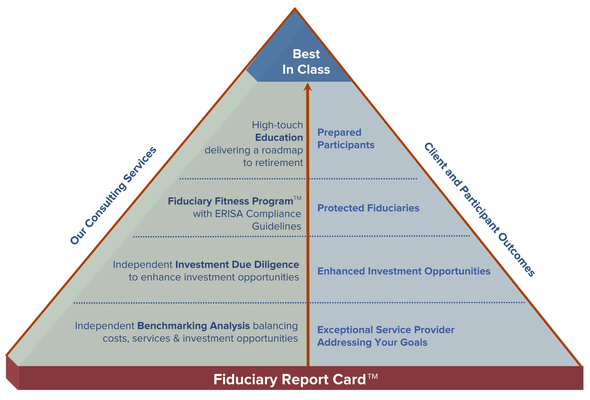

At 401(k) & 403(b) Fiduciary Advisors, our Services focus on creating and maintaining a successful retirement plan. Just as every plan participant is an individual with his/her retirement objectives and goals, every plan sponsor has their own objectives and goals as well. As your trusted retirement plan advisor, 401(k) & 403(b) Fiduciary Advisors will design the best retirement plan for your company or non-profit and develop an ongoing service plan to meet your specific needs.

retirement plan. Just as every plan participant is an individual with his/her retirement objectives and goals, every plan sponsor has their own objectives and goals as well. As your trusted retirement plan advisor, 401(k) & 403(b) Fiduciary Advisors will design the best retirement plan for your company or non-profit and develop an ongoing service plan to meet your specific needs.

If you want a competitive retirement plan benefit to (1) support your hiring and retention of top-notch employees, (2) meet ERISA compliance and (3) be actively monitored by a professional, then 401(k) & 403(b) Fiduciary Advisors should be your retirement plan advisor.